Meaning of Journal in Financial Accounting with Example

Journal is a first Accounting Record Book,in which all the transactions of a business organization are recorded in chronological or orderly manner i.e ascending date wise order from the primary Accounting documents like Credit Voucher,Debit Voucher,Purchase Invoice,Sales Invoice,Bank Payment Acknowledgement,Bank Deposit Slip or Pay-in-Slip etc.

Due to the first entry of Original transactions in Journal, this is also called the "Book of Original Entry"

For recording the Journal Book or Journal Register,one has to follow/understand the below mentioned three topics.

Types or Classification of Accounts - For details about types of Account click here

Debit and Credit Rule - Click here to know details.

Rules of Double Entry System of Book Keeping - For details about Rules of Double Entry System of Book Keeping click here

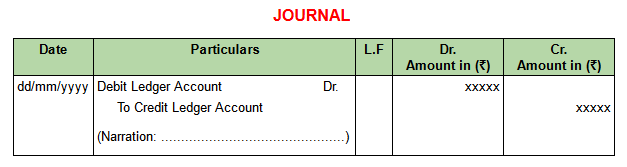

Sample format of Journal in Financial Accounting

Journal consists of Five Columns

Date : This column explains in which date the transaction occurred.

Particulars : This column shows both Debit Ledger Account and Credit Ledger Account with Narration.

First,all the Debit Ledger Accounts and then all the Credit Ledger Accounts are recorded.

On the left side "Debit Ledger Accounts" and on the right side "Dr." symbol for each Debit Ledger Accounts are used.

Just below to the last Debit Ledger Account,Credit Ledger Accounts are written by using some blank space from the left side with the prefix word "To".

After recording the Debit and Credit Ledger Accounts "Narration" is written,which tells about the detail description of transaction.

Ledger Folio(L.F) : This is the column of related Ledger Page Numbers for a particular Journal Entry.

Debit(Dr.) : Debit Ledger Amounts are shown in this column.

Commonly,Currency symbol is mentioned on the main Header of Debit column

Credit(Cr.) : Credit Ledger Amounts are shown in this column.

Commonly,Currency symbol is mentioned on the main Header of Credit column

Some Examples of Journal with Format

Example -1

Let's Pass necessary Journal Entries in the Books of a Proprietorship Business "M/s.RS Food Products" of the below mentioned Business Transactions.

Date : 05/05/2020

Mr.Rohit Sharma started a Sole Proprietorship business with a Trade name M/s.RS Food Products(Whole Sale Trader of Edible/Cooking Oil),Bhubaneswar,Odisha by investing cash for ₹5,50,000/-

Date : 06/05/2020

Opened a Current Account with State Bank of India by depositing cash for ₹48,000/-

Date : 06/05/2020

Purchased Furniture and fixtures for ₹32,500/- from M/s.Dev Wood as per Cash Memo No-1350.

The above mentioned three Journal Entries in the Books of M/s.RS Food Products are in Simple Journal Entry form. Because these Journal entries have only One Credit Ledger Account for One Debit Ledger Account.

Types of Journal Entry

Mainly, there are two types of Journal Entries are passed in Financial Accounting.

Simple Journal Entry

Compound Journal Entry

Simple Journal Entry :

Simple Journal Entries are the Journal Entries which have One Debit Account and One Credit Account for each Journal Entry.

The Debit Ledger amount must be equal to the Credit Ledger amount.

Compound Journal Entry :

Compound Journal Entries are the Journal Entries which have more than One Debit Account and/or more than One Credit Account for each Journal Entry.

The Debit total amount must be equal to the Credit total amount.

You can see the Journal Entry(Example -2) given below in the Books of "M/s. Odisha Fashion Designer" for Capital Investment Entry, to know how Compound Journal Entries are passed.

Let's pass necessary Journal Entries in the Books of a Partnership Business "M/s. Odisha Fashion Designer" for the below mentioned transactions.

Date : 01/04/2021

Mr. Anil and Mr. Vijay decided to start a Partnership Business named "M/s.Odisha Fashion Designer" with Capital Investment equally by Cash, i.e Mr.Anil invested ₹3,50,000/- and Mr. Vijay invested ₹3,50,000/-.

Date : 02/04/2021

Opened a Current Account with HDFC Bank Limted by despositing Cash for ₹65,000/-.

Date : 02/04/2021

Purchased Furniture and Fixture from M/s. Furniture House as per Cash Memo No-185 for ₹92,300/-.

Date : 05/04/2021

Amount paid to Computer Centre for ₹51,490/- vide Chq No-000123 of HDFC Bank Current Account towards purchase of Computer.

Note: In Debit and Credit column you can use Currency symbol of different Countries as per your Account Book needs.

More coverage on Journal/Journal Entry :

Now let's know about Journal Entry on different type of transactions.

1. Journal Entry for Purchase of Goods.

When goods are purchased,

Purchases Account shows debit effect and

Cash/Bank/Creditor/Supplier/Party Account shows Credit effect.

Given below is the Journal Entry for Purchase of Goods.

For detail explanation on Purchase of Goods,see the post Recording of transactions for purchase of Goods in the Books of Account with Journal Entry from which you can know accounting treatment for,

Cash Purchase and Credit Purchase of Goods without charging Indirect Tax like VAT/GST etc.

Click this link Recording of transactions for purchase of Goods charging indirect taxes like GST/VAT in the Books of Account with Journal Entry to know the Accounting treatment for Purchase of Goods charging Indirect Taxes like GST/VAT, when you have to maintain separate GST/VAT ledger account.

2. Journal Entry for Sale of Goods.

When goods are sold,

Cash/Bank/Debtor/Buyer/Party Account shows Debit effect and,

Sales Account shows Credit effect.

Given below is the Journal Entry for Sale of Goods.

Click here to know about the Accounting treatment for Sale of Goods(Both Cash Sale and Credit Sale) without charging Indirect tax like GST/VAT etc.

Click here to know about the Accounting treatment for Sale of Goods(Both Cash Sale and Credit Sale) with charging Indirect tax like GST/VAT etc.

3. Journal Entry for Cash Deposit into Bank.

When Cash are deposited into Bank,

Bank Account shows Debit effect and,

Cash Account shows Credit effect.

Given below is the Journal Entry for Cash Deposit into Bank.

To know, details about Cash Deposit into Bank showing Journal Entry and Ledger Posting with Example click the link Accounting treatment for Cash Deposit into Bank.

4. Journal Entry for Cash Withdrawal from Bank.

When Cash are withdrawn from Bank,

Cash Account shows Debit effect and,

Bank Account shows Credit effect.

Given below is the Journal Entry for Cash Withdrawal from Bank.

To know, details about Cash withdrawal from Bank showing Journal Entry and Ledger Posting with Example click the link Accounting treatment for Cash withdrawal from Bank.5. Journal Entry for Purchase of Fixed Assets, paid by Cash

When Fixed Assets are purchased and payment made by Cash,

Fixed Asset Account shows Debit effect and,

Cash Account shows Credit effect.

Given below is the Journal Entry for Purchase of Fixed Assets, paid by Cash.

Click here to know details about Journal Entry and Ledger Posting on Purchase of Fixed Assets, paid by Cash.

6. Journal Entry for Purchase of Fixed Assets, paid through Bank Account

When Fixed Assets are purchased and payment made through Bank Account.

Fixed Asset Account shows Debit effect and,

Bank Account shows Credit effect.

Given below is the Journal Entry for Purchase of Fixed Assets, paid through Bank Account.

Click here to know details about Journal Entry and Ledger Posting on Purchase of Fixed Assets, paid through Bank Account.7. Journal Entry for Credit Purchase of Fixed AssetsWhen credit purchase of Fixed Assets are made,

Fixed Asset Account shows Debit effect and,

Sundry Creditor Account shows Credit effect.

Given below is the Journal Entry for Credit Purchase of Fixed Assets.

To know details about Journal Entry and Ledger posting for Credit Purchase of Fixed Assets with example click here8. Journal Entry for Cash payment towards Carriage Inward Expenses on Purchase of Goods

On Cash payment towards Carriage Inward Expenses, the following Ledger Accounts are affected.

Carriage Inward Account shows debit effect and,

Cash Account shows Credit effect.

Journal Entry for the above transaction should be passed as mentioned below.

Click here to know detail explanation with Journal Entry and Ledger Posting for the above transaction.9. Journal Entry for Carriage Inward Expenses on Purchase of Goods, payment through Bank Account

When payment are made through Bank Account towards Carriage Inward Expenses, the following Ledger Accounts are affected.

Carriage Inward Account shows debit effect and,

Bank Account shows Credit effect.

Journal Entry for the above transaction should be passed as mentioned below.

Click here to know details about Journal Entry and Ledger Posting with example for the transaction Carriage Inward Expenses paid through Bank Account.10. Journal Entry for Carriage Inward Expenses incurred but not yet paid.

Carriage Inward Expenses incurred but not yet paid means, expenses made on Credit basis i.e Expenses booked in the Ledger Account and Financial Statements but paid later date.

This is one type of Credit transaction for expenses.

Ledger Accounts involved in this transaction are :

Debit Account :

- Carriage Inward Account

Credit Account :

- Carriage Inward Payable Account

Journal Entry

Click here to know details about Journal Entry and Ledger Posting with example for the transaction Carriage Inward Expenses incurred but not yet paid.

11. Journal Entry for Cash payment towards Loading and Unloading Expenses on Purchase of Goods

On Cash payment towards Loading & Unloading Expenses, the following Ledger Accounts are affected.

Loading & Unloading Expenses Account shows debit effect and,

Cash Account shows Credit effect.

Journal Entry for the above transaction is mentioned below.

Click here

to know details about Journal Entry and Ledger Posting with example for

the transaction Loading and Unloading Expenses paid by Cash for Purchase of Goods.

12. Journal Entry for Loading and Unloading Expenses on Purchase of Goods, payment through Bank Account

On payment through Bank Account towards Loading & Unloading Expenses, the following Ledger Accounts are affected.

Loading & Unloading Expenses Account shows debit effect and,

Bank Account shows Credit effect.

Journal Entry for the above transaction is mentioned below.

To know more about Journal Entry and Ledger posting for the above transaction with example click here.

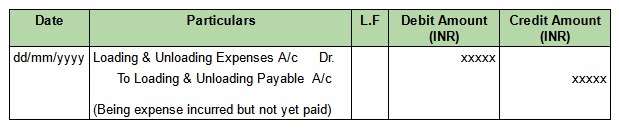

13. Journal Entry for Loading and Unloading Expenses on purchase of goods incurred but not yet paid.

Loading and Unloading Expenses incurred but not yet paid means, expenses made on Credit basis i.e Expenses booked in the Ledger Account and Financial Statements but paid later date.

This is one type of Credit transaction for Loading & Unloading Expenses.

In this type of transaction,

Loading & Unloading Expenses Account shows Debit effect and,

Loading & Unloading Payable Account shows Credit effect.

Journal Entry for the above transaction.

Click here to know details about Journal Entry and Ledger Posting with Example for the above transaction.

14. Journal Entry for Cash payment towards Wages.

On payment of Cash towards Wages, the following Ledger Accounts are affected.

Wages Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

15. Journal Entry for Wage Expenses, paid through Bank Account

On payment of Wages through Bank Account, the following Ledger Accounts are affected.

Wages Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

16. Journal Entry for Wage Expenses incurred but not yet paid

When Expenses incurred but not yet paid i.e outstanding Wages or Wages are payable, the following Ledger Accounts are affected.

Wages Account shows Debit effect and,

Wages Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

17. Journal Entry for Cash payment towards Salary.

When payments are made by Cash on the head of Salaries, following Ledger Accounts are affected.

Salaries Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

18. Journal Entry for Salary paid through Bank Account

When payments are made through Bank Account on the head of Salaries, following Ledger Accounts are affected.

Salaries Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

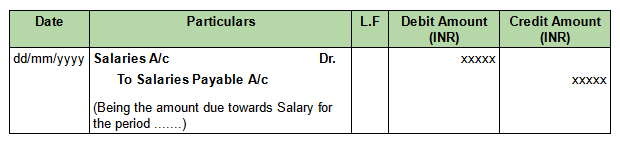

19. Journal Entry for Salary Expenses incurred but not yet paid.

When Salary Expenses incurred but not yet paid, following Ledger Accounts are affected.

Salaries Account shows Debit effect and,

Salaries Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

Click here to know Journal Entry using TallyPrime for this type of transaction.

20. Journal Entry for Cash payment towards Rent.

On payment of Cash towards Rent Expenses, following Ledger Accounts are affected.

Rent Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

21. Journal Entry for Rent paid through Bank Account

On payment of Rent Expenses through Bank Account, following Ledger Accounts are affected.

Rent Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

22. Journal Entry for Rent Expenses incurred but not yet paid.

When Rent Expenses incurred but not paid, following Ledger Accounts are affected.

Rent Account shows Debit effect and,

Rent Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

23. Journal Entry for Cash payment towards Advertisement Expenses.

When Advertisement Expenses are paid through Cash, following Ledger Accounts are affected.

Advertisement Expenses Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

24. Journal Entry for Advertisement Expenses paid through Bank Account

When Advertisement Expenses are paid through Bank Account, following Ledger Accounts are affected.

Advertisement Expenses Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

25. Journal Entry for Advertisement Expenses incurred but not yet paid.

When Advertisement Expenses incurred but not yet paid, following Ledger Accounts are affected.

Advertisement Expenses Account shows Debit effect and,

Advertisement Expenses Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

26. Journal Entry for Service Charges deducted by the Bank.

When your Bank charges some amount for the Service provided like Cheque clearing charges, Cheque return Charges, ATM/Debit Card Charges, Non maintenance of Minimum Balance Charges, Cash handling Charges etc., the following Ledger Accounts are affected.

Bank Charges Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

27. Journal Entry for Cash Payment towards Electricity Expenses.

When Electricity expenses are paid through Cash, the following Ledger Accounts show effect.

Electricity Expenses Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

28. Journal Entry for Electricity Expenses paid through Bank Account

When Electricity expenses are paid through Bank Account, the following Ledger Accounts show effect.

Electricity Expenses Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

29 . Journal Entry for Electricity Expenses incurred but not yet paid i.e Outstanding Electricity Expenses

When Electricity expenses are incurred but not yet paid, the following Debit Ledger and Credit Ledger Accounts are affected.

Electricity Expenses Account shows Debit effect and,

Electricity Expenses Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

30. Journal Entry for Cash Payment towards Telephone Expenses.

When Telephone expenses are paid through Cash, the following Ledger Accounts show effect.

Telephone Expenses Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

31. Journal Entry for Telephone Expenses paid through Bank Account

When Telephone expenses are paid through Bank Account, the following Ledger Accounts show effect.

Telephone Expenses Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

32. Journal Entry for Telephone Expenses incurred but not yet paid i.e Outstanding Telephone Expenses

When Telephone expenses are incurred but not yet paid, the following Debit Ledger and Credit Ledger Accounts are affected.

Telephone Expenses Account shows Debit effect and,

Telephone Expenses Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

33. Journal Entry for Cash Payment towards Printing & Stationery Expenses.

When Printing & Stationery expenses are paid through Cash, the following Ledger Accounts show effect.

Printing & Stationery Expenses Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

34. Journal Entry for Printing & Stationery Expenses paid through Bank Account

When Printing & Stationery expenses are paid through Bank Account, the following Ledger Accounts show effect.

Printing & Stationery Expenses Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

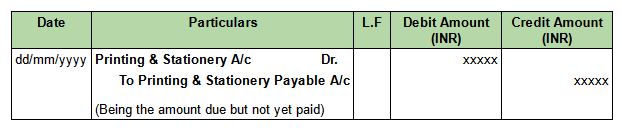

35. Journal Entry for Printing & Stationery Expenses incurred but not yet paid i.e Outstanding Printing & Stationery Expenses

When Printing & Stationery expenses are incurred but not yet paid, the following Debit Ledger and Credit Ledger Accounts are affected.

Printing & Stationery Expenses Account shows Debit effect and,

Printing & Stationery Expenses Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

36. Journal

Entry for Accrued Interest on Bank Fixed Deposits

When Interest on Bank Fixed Deposits earned but not yet received i.e Interest is Receivable/Accrued, the

following Debit Ledger and Credit Ledger Accounts are affected.

Fixed Deposit Account shows Debit effect and,

Interest on Fixed Deposit Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

37. Journal

Entry for Interest on Bank Fixed Deposits when TDS is applicable.

When Interest on Bank Fixed is earned and subject to TDS, the

following Debit Ledger and Credit Ledger Accounts are affected.

Fixed Deposit Account shows Debit effect.

TDS Account shows Debit effect.

Interest on Fixed Deposit Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

38. Journal

Entry for Commission Expenses paid by Cash.

When Commission Expenses is paid by Cash, the

following Debit Ledger and Credit Ledger Accounts are affected.

Commission Account shows Debit effect.

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

39. Journal

Entry for Commission Expenses paid through Bank Account.

When Commission Expenses is paid through Bank Account, the

following Debit Ledger and Credit Ledger Accounts are affected.

Commission Account shows Debit effect.

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

40. Journal

Entry for Commission Expenses incurred but not yet paid.

When Commission Expenses is due but not yet paid, the

following Debit Ledger and Credit Ledger Accounts are affected.

Commission Account shows Debit effect.

Commission Payable Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

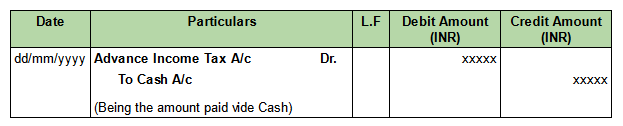

41. Journal Entry for Cash payment towards Advance Income Tax.

When Advance Income Tax is paid by Cash, the

following Debit Ledger and Credit Ledger Accounts are affected.

Advance Income Tax Account shows Debit effect.

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

42. Journal Entry for payment of Advance Income Tax through Bank Account.

When Advance Income Tax is paid through Bank Account, the

following Debit Ledger and Credit Ledger Accounts are affected.

Advance Income Tax Account shows Debit effect.

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

43. Journal

Entry for Cash withdrawals by the Proprietor of a Business.

When Proprietor withdraws Cash from Business for personal use, the

following Debit Ledger and Credit Ledger Accounts are affected.

Drawings Account shows Debit effect.

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

44. Journal

Entry for Cash withdrawals by the Partners of a Business.

When Partners withdraw Cash from Business for their personal use, the

following Debit Ledger and Credit Ledger Accounts are affected.

Partners Capital Account shows Debit effect.

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

45. Journal

Entry for Cash Payment to Sundry Creditors.

On Cash payment to Sundry Creditors, the

following Debit Ledger and Credit Ledger Accounts are affected.

Sundry Creditors Account shows Debit effect.

Cash Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

46. Journal

Entry for Payment to Sundry Creditors through Bank Account.

On payment to Sundry Creditors through Bank Account, the

following Debit Ledger and Credit Ledger Accounts are affected.

Sundry Creditors Account shows Debit effect.

Bank Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

47 . Journal Entry for Depreciation on Fixed Assets

Depreciation is an expense related to Tangible Fixed Assets over its useful life. It is the decreasing or reducing value of Fixed Assets during an Accounting year/period.

Depreciation is charged as per the rate percentage prescribed by different Acts such as Companies Act 2013, Income Tax Act 1961 etc. for preparation of Final Account.

When Depreciation is charged on Fixed Assets like Furniture & Fixture, Plant and Machinery etc.

Depreciation Account shows Debit effect and

Fixed Assets Account shows Credit effect.

Journal Entry for this transaction.

Click here to know more about Journal Entry and Ledger Posting for the above transaction with example.

.png)

Comments

Post a Comment