Salaries are the amount of expense which is paid to the employees of a Business Organization against their service provided.

Generally Salaries are fixed in nature for one Accounting Year.

Salaries are paid in Monthly/Quarterly/Half Yearly/Yearly basis.

In maximum cases Salaries are paid in Monthly basis.

Now let's discuss about the Journal Entry and Ledger posting procedure when Salaries are paid through Cash.

On Cash Payment for Salaries,

Salaries Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry

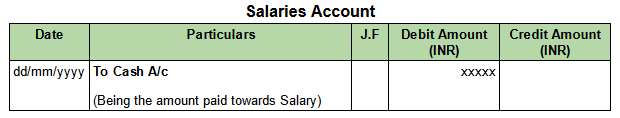

Ledger Posting

In Salaries Ledger Account.

In Cash Account

Example :

In the Books of M/s.Trimurthy Traders, Salary paid to employees for ₹10000/- on dt.02/05/2021 for the month of April' 2021.

Pass necessary Journal Entry and Post them into their respective Ledger Accounts for Salary paid through Cash

In the above example

Debit Ledger is :

- Salaries Account

Credit Ledger is :

- Cash Account

Journal Entry

Ledger Posting

In Salaries Ledger Account.

In Cash Account.

Comments

Post a Comment