Let's come to discuss about the Accounting treatment for Sale of Goods with Journal Entry charging Indirect taxes like GST/VAT etc.

When Sale of Goods with charging Indirect Taxes like GST/VAT are made, one have to record/maintain the below mentioned Accounting Records.

Preparation of Sales Invoice/Bill/Cash Memo

Recording of Journal Entry into the Journal Register.

Posting of Corresponding Ledger Account from the Recorded Journal Entry.

Recording in Sales Register etc.

When Goods are sold with charging Indirect tax like GST/VAT on immediate Cash Receipt i.e Cash Sale of Goods.

Debit Account :

Cash Account

Credit Account :

Sales Account

GST Account

Journal Entry :

Ledger Posting :

In Cash Ledger/Cash Book.

In Sales Ledger/Sales Account.

In GST Ledger Account.

Recording in Sales Register.Example :

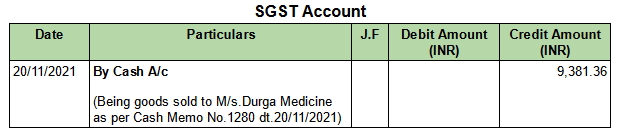

In the Books of M/s.Triveni Medicare, Bhubaneswar, Odisha(GSTIN-21ACHPD1234Q1Z9) Goods sold for Cash to M/s.Durga Medicine, Raygada, Odisha,GSTIN - 21AAHFD0909P1ZQ for ₹1,23,000/-(Taxable Value ₹1,04,237.28, CGST ₹9381.36, SGST ₹9381.36) as per Cash Memo No. 1280 dt.20/11/2021.

Debit Account :

- Cash Account

Credit Accounts :

Sales Account

CGST Account

SGST Account

Journal Entry :

Ledger Posting :

In Cash Ledger/Cash Book.

In Sales Ledger Account.

In CGST Ledger Account.

In SGST Ledger Account.

Recording in Sales Register.

When Goods are sold with charging Indirect tax like GST/VAT on immediate Cash Receipt i.e Cash Sale of Goods(Receipt through Bank Account).

Debit Account :

Bank Account

Credit Account :

Sales Account

GST Account

Journal Entry :

Ledger Posting :

In Bank Ledger/Bank Book.

In Sales Ledger/Sales Account.

In GST Ledger/GST Account.Recording in Sales Register.

Example :

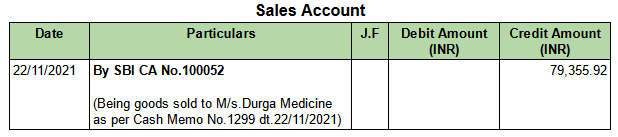

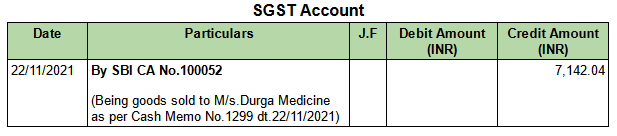

In the Books of M/s.Triveni Medicare, Bhubaneswar, Odisha(GSTIN-21ACHPD1234Q1Z9) Goods sold for Cash(NEFT credit to SBI CA No.100052) to M/s.Durga Medicine, Raygada, Odisha,GSTIN - 21AAHFD0909P1ZQ for ₹93,640/-(Taxable Value ₹79,355.92, CGST ₹7,142.04, SGST ₹7,142.04) as per Cash Memo No. 1299 dt.22/11/2021.

Debit Account :

- SBI CA No.100052

Credit Accounts :

Sales A/c

CGST A/c

SGST A/c

Journal Entry :

Ledger Posting :In SBI CA No.100052.

In Sales Ledger Account.

In CGST Ledger Account.

In SGST Ledger Account.

Recording in Sales Register.When Goods are sold with charging Indirect tax like GST/VAT on Credit i.e Credit Sale of Goods.

Debit Account :

Sundry Debtor's/Party/Buyer Account

Credit Account :

Sales Account

GST Account

Journal Entry :

Ledger Posting :In Sundry Debtors Ledger.

In Sales Ledger/Sales Account.

In GST Ledger/GST Account.

Example :

In the Books of M/s.Triveni Medicare, Bhubaneswar, Odisha(GSTIN-21ACHPD1234Q1Z9) Goods sold to M/s.Durga Medicine, Raygada, Odisha,GSTIN - 21AAHFD0909P1ZQ for ₹1,75,700/-(Taxable Value ₹1,48,898.30, CGST ₹13,400.85, SGST ₹13,400.85) as per Invoice No. 1320 dt.25/11/2021.

Debit Account :

- M/s. Durga Medicine

Credit Accounts :

Sales A/c

CGST A/c

SGST A/c

Journal Entry :

Ledger Posting :In M/s.Durga Medicine Ledger Account.

In Sales Ledger Account.

In CGST Ledger Account.

In SGST Ledger Account.

Recording in Sales Register.

Comments

Post a Comment