Sometimes, Balance amount as per Record maintained by an Account Holder of Bank for a Particular Bank Account shows a mismatch with the Balance as per Bank Statement/Bank Passbook at the end of a Particular date.

Keeping eye on the above matter, Bank Reconciliation Statement is prepared to know the reason of mismatch.

So, Bank Reconciliation Statement in Financial Accounting is a statement which gives a complete and satisfactory information about the reason of mismatch between :

Ledger/Record maintained by a Business Unit or an Individual for a Particular Bank Account and

Bank Statement/Pass Book maintained by the Bank for that Account.

For more understanding on Bank Reconciliation Statement, Let's come to a discussion with an Example.

Mr.Sachin is a Customer of State Bank of India having Savings Account bearing No-10002000333.

As per Record of Mr.Sachin.

Opening Balance as on Date 31/03/2021 is ₹27380.00(Dr.)

Transactions occurred on date 31/03/2021.

Cash Deposited into SBI SB A/c No-10002000333 for ₹25600.00

Cheque No-201410 for ₹3500.00 issued to S.Kumar.

Received from Miss Priya towards consultancy fees for ₹6950.00 through NEFT.

Received Cheque No-000111 of HDFC Bank from Dinesh Pandey for ₹2000 and deposited on date 31/03/2021.

Closing Balance = Debit Total - Credit Total (₹61930 - ₹3500)

Closing Balance as on date 31/03/2021 is ₹58430 (Dr.)

As per Bank Statement or Bank Passbook.

Opening Balance as on Date 31/03/2021 is ₹27380.00(Cr.)

Transactions occurred on date 31/03/2021.

Cash Deposited into SBI SB A/c No-10002000333 for ₹25600.00

NEFT Credit from Miss Priya towards consultancy fees for ₹6950.00.

Credit Total amount = ₹27380 + ₹25600 + ₹6950 = ₹59930

Closing Balance = Credit Total - Debit Total (₹59930 - 0)

Closing Balance as on date 31/03/2021 ₹59930 (Cr.)

From the above two records i.e Bank Account Ledger as per Account Holder and Bank Account Ledger as per State Bank of India shows a closing balance amount mismatch on date 31/03/2021.

Now it is time to prepare a Bank Reconciliation Statement.

Bank Reconciliation Statement when Closing Balance of Bank Pass Book is taken into consideration at the beginning.

Bank Reconciliation Statement as on date 31/03/2021.

Bank Reconciliation Statement when Closing Balance of Account Holder's Ledger is taken into consideration at the beginning.Balance as per Bank Passbook ₹59930.

Add: Deposits not reflected in Bank Passbook ₹2000.

Less: Withdrawals not reflected in Bank Passbook ₹3500.

Balance as per Account Holder's Ledger ₹58430.

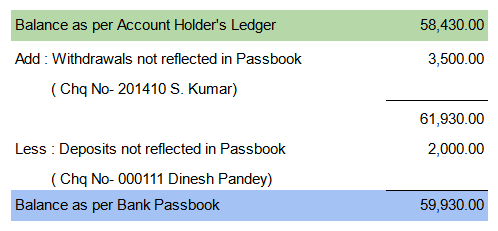

Bank Reconciliation Statement as on date 31/03/2021.

Balance as per Account Holder's Ledger ₹58430.

Add: Withdrawals not reflected in Bank Passbook ₹3500.

Less: Deposits not reflected in Bank Passbook ₹2000.

Balance as per Bank Passbook ₹59930.

Balance as per Account Holder's Ledger is taken into consideration for preparing Balance Sheet of Account Holder.

Comments

Post a Comment