Rent is a amount of consideration, which is paid by the User of any property such as Land, Land and Building, Vehicle, Machinery etc to Owner of the property within a fixed interval of time.

Let's discuss about the Journal Entry and Ledger Posting procedure for Rent expenses incurred but not yet paid.

When Rent Expenses incurred but not paid till date, the following Ledger Accounts will be affected.

Rent Account shows Debit effect and,

Rent Payable Account shows Credit effect.

Journal Entry

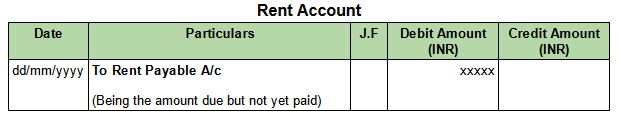

Ledger Posting

In Rent Ledger Account

In Rent Payable Account

Example :In the Books of M/s.Trimurthy Traders, Rent Expenses incurred for the month of March' 2022 for ₹4000/- but not yet paid .

Pass necessary Journal Entry and Post them into their respective Ledger Accounts for the above transaction.

In the above example

Debit Ledger is :

- Rent Account

Credit Ledger is :

- Rent Payable Account

Journal Entry

Ledger Posting

In Rent Ledger Account

In Rent Payable Ledger Account

Comments

Post a Comment