In

current days all the Individuals and Business units are using Electric

power for maintenance of their Production Unit and Office.

The Electricity provider charges/bills towards consumption value on the users of Electric power.

Let's discuss how to record the transaction when Electricity Expenses are incurred but not yet paid.

When Electricity Expenses incurred but not yet paid, the following Ledger Accounts are affected.

Electricity Expenses Account shows Debit effect.

Electricity Expenses Payable Account shows Credit effect.

Journal Entry

Ledger Posting

In Electricity Expenses Ledger Account.

In Electricity Expenses Payable Ledger Account.

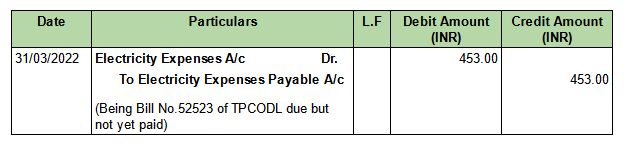

Example :

In the Books of M/s.Trimurthy Traders, Bill No.52523 for ₹453/- received from TPCODL on dt.31/03/2022 towards Electricity Charges for the month of March' 2022.

Pass necessary Journal Entry and post them into their respective Ledger Account.

In the above transaction, Ledger Accounts involved are :

Debit Ledger :

- Electricity Expenses Account

Credit Ledger :

- Electricity Expenses Payable Account

Journal Entry

Ledger PostingIn Electricity Expenses Ledger Account

In Electricity Expenses Payable Ledger Account.

Comments

Post a Comment