Advance Income Tax is the tax Liability payable by a Tax Payer within due date prescribed by the Income Tax Department.

It is paid during a Financial Year on estimated Income for that Financial Year.

Advance Tax paid during the Year will be adjusted on Return Filing date against total Income Tax payable.

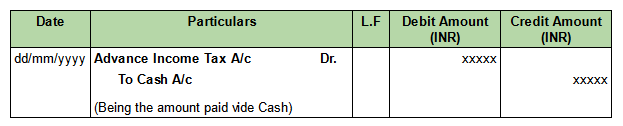

Now let's discuss on Journal Entry and Ledger Posting, when Advance Income Tax is paid by Cash.

When Advance Income Tax is paid by Cash, the following Debit Ledger and Credit Ledgers are affected.

Debit Ledger is :

- Advance Income Tax Account

Credit Ledger is :

- Cash Account

Journal Entry

Ledger Posting

In Advance Income Tax Ledger Account.

In Cash AccountExample :

In the Books of M/s.Trupti Food Products, amount paid by Cash towards Advance Income Tax for the Assessment Year 2024-25 on dt.10/06/2023 for ₹25,000/- as per Challan Ref No.232323.

Pass necessary Journal Entry and post them into their respective Ledger Account for the above transaction.

In this transaction,

Debit Ledger is :

- Advance Income Tax Account

Credit Ledger is :

- Cash Account

Journal Entry

Ledger Posting

In Advance Income Tax Ledger Account.

In Cash Account

Comments

Post a Comment