Printing & Stationery Expenses Ledger Account is popularly used by Accountants for maintaining Books of Account of a Business Organization.

Printing & Stationery Expenses include :

Purchase of Printing materials such as

Printing Paper

Writing paper pads

Printer Cartridge Refilling ink

Document xerox charges etc. for office use.

Purchase of office stationery such as

Pen

Pencil

Eraser

Files/Folders

Thread Tag/File Tag/Binding Lace

Stamp pad ink

Alpin Box

Paper pasting gum etc. for office use.

Now let's discuss about Journal Entry and Ledger Posting procedure, when printing and stationery expenses incurred but not yet paid.

When Printing and stationery expenses incurred but not yet paid, the affected Ledger Accounts are :

Printing & Stationery Ledger Account shows Debit effect and,

Printing & Stationery Payable Ledger Account shows Credit effect.

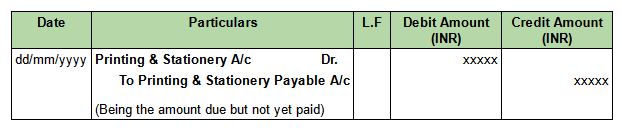

Journal Entry

Ledger Posting

In Printing & Stationery Expenses Ledger Account.

In Printing & Stationery Payable Account.

Example :In the Books of M/s.Trimurthy Traders, Office Stationery purchased from 'Lucky Store' for ₹1270/- on dt.31/03/2022 as per Inv No.1514.

Pass necessary Journal Entry and post them into their respective Ledger Account for the above mentioned transaction.

In the above transaction,

Debit Ledger is :

- Printing & Stationery Account

Credit Ledger is :

- Printing & Stationery Payable Account

Journal Entry

Ledger Posting

In Printing & Stationery Ledger Account

In Printing & Stationery Payable Ledger Account.

Comments

Post a Comment