Recording of transactions for purchase of Goods charging indirect taxes like GST/VAT in the Books of Account with Journal Entry

When Goods are purchased charging indirect taxes like GST/VAT on immediate Cash Payment i.e Cash Purchase of Goods charging indirect taxes like GST/VAT.

Debit Accounts :

Purchases Account

GST Account.

Credit Account - Cash Account.

Journal Entry :

Ledger Posting :

In Cash Ledger/Cash Book.

In GST Ledger.

Recording in Purchase Register.

Example :

In the books of M/s. Shine Furniture,Bhubaneswar, Odisha, Goods purchased from M/s.King Plastic,Mumbai, GSTIN-27ABKFM8135M1Z0 for ₹1,98,280/-(Taxable Value ₹1,68,033.90, IGST ₹30,246.10) as per Cash Memo No. 1790 dt.11/08/2021.

Journal Entry :

Ledger Posting :

In Cash Ledger/Cash Book.

In Purchases Ledger.

In IGST Ledger.

Recording in Purchase Register.

When Goods are purchased charging indirect taxes like GST/VAT on immediate Payment through Bank Account i.e Cash Purchase of Goods charging indirect taxes like GST/VAT(Payment through Bank Account).

Debit Accounts :

Purchases Account

GST Account.

Credit Account - Bank Account.

Journal Entry :

Ledger Posting :

In Bank Account/Bank Ledger.

In Purchases Account/Purchases Ledger.In GST Ledger.

Recording in Purchase Register.

Example :

In the books of M/s. Shine Furniture,Bhubaneswar, Odisha, Goods purchased from M/s.King Plastic,Mumbai, GSTIN-27ABKFM8135M1Z0 for ₹2,70,550/-(Taxable Value ₹2,29,279.66, IGST ₹41,270.34) as per Cash Memo No.1820 dt.17/08/2021 paid by RTGS from Bank of India Current A/c No.20001562345.

Journal Entry :

Ledger Posting :

In Bank Account/Bank Ledger.

In Purchases Account/Purchases Ledger.

In IGST Ledger.

Recording in Purchase Register.

When Goods are purchased charging indirect taxes like GST/VAT on Credit i.e Credit Purchase of Goods charging indirect taxes like GST/VAT.

Debit Accounts :

Purchases Account

GST Account.

Credit Account - Supplier/Sundry Creditor/Vendor Account

Journal Entry :

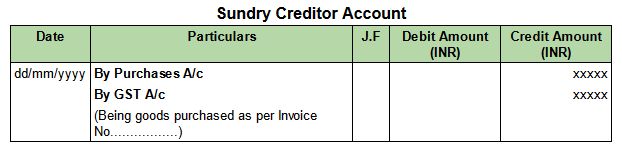

Ledger Posting :

In Sundry Creditors Ledger.

In Purchases Ledger.

In GST Ledger.

Recording in Purchase Register.

Example :

In the books of M/s. Shine Furniture,Bhubaneswar, Odisha, Goods purchased from M/s.King Plastic,Mumbai, GSTIN-27ABKFM8135M1Z0 for ₹3,90,635/-(Taxable Value ₹3,31,046.61, IGST ₹59,588.39) as per Invoice No.1930 dt.05/09/2021

Debit Accounts :

Purchases Account

IGST Account.

Credit Account -M/s. King Plastic, Mumbai

Journal Entry :

Ledger Posting :

In M/s.King Plastic,Mumbai Ledger(Supplier/Creditor/Vendor).

In Purchases Account/Purchases Ledger.

In IGST Ledger Account.

Recording in Purchase Register.

.png)

Comments

Post a Comment