Carriage Inward Expenses means the expenses in the Books of Purchaser which are made on Purchase of Goods either Raw Material or Trading Goods for bringing the Goods from Seller's place to Buyer's place/godown.

Let's discuss about the procedure of Journal Entry and Ledger Posting for Carriage Inward Expenses, when payments are made through Bank Account.

On payment of Carriage Inward Expenses through Bank Account(NEFT/RTGS/Cheque/DD/UPI etc.),

Carriage Inward Account shows Debit effect and,

Bank Account shows Credit effect.

Journal Entry

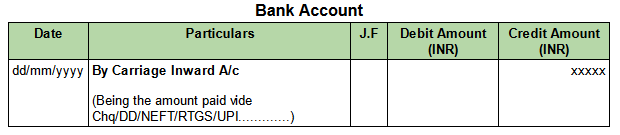

Ledger Posting

In Carriage Inward Account

In Bank Account

Example :

In the Books of M/s.Jagannath Industries goods purchased for ₹4,70,000/- and paid Carriage through NEFT Ref No-52405321 of HDFC Bank Current Account No-7020 for ₹12,350/- on dt.25/11/2022 to bring the goods to godown.

Pass necessary Journal Entry and Post them into their respective Ledger Accounts for Carriage paid.

In the above example

Debit Ledger is :

- Carriage Inward Account

Credit Ledger is :

- HDFC Bank CA No-7020

Journal Entry

Ledger Posting

In Carriage Inward Account.

In HDFC Bank CA No-7020

Comments

Post a Comment