Wages are the expenses of a Business organization which is paid to person/persons against their work done for that Business organization.

Generally wages are not fixed in nature, it varies from time to time and it is paid within a short period of time.

Wages are paid hourly/daily/weekly basis.

Now let's discuss about the Journal Entry and Ledger posting procedure when Wages are paid through Cash.

On Cash Payment for Wages,

Wages Account shows Debit effect and,

Cash Account shows Credit effect.

Journal Entry

Ledger Posting

In Wages Ledger Account

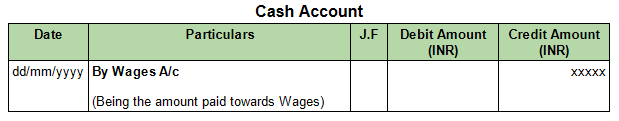

In Cash Account

Example :

In the Books of M/s.Jagannath Industries amount paid towards wages by Cash for ₹1230/- on dt.20/11/2022

Pass necessary Journal Entry and Post them into their respective Ledger Accounts for Wages paid.

In the above example

Debit Ledger is :

- Wages Account

Credit Ledger is :

- Cash Account

Journal Entry

Ledger Posting

Posting in Wages Ledger Account.

Posting in Cash Account.

Comments

Post a Comment