Practice Sheet - 9 of 12 (Transactions for the month of Dec' 2021)

Students/learners can get benefit and complete knowledge on this Practical Project after completion of all the 12 Practice Sheets with a proper sequence.

Let's Practice the below mentioned transactions with Journal Entry for the month of December' 2021 of Trimurthy Traders(Prop : Surya Krishnamurthy).

TRIMURTHY TRADERS

(Prop : Mr. Surya Krishnamurthy)

Financial Year : 2021-22(April' 2021 to March' 2022)

Assessment Year : 2022-23(April' 2022 to March' 2023)

Date : 01/12/2021 (Transaction No. 151)

Amount paid to Sagar Traders, Odisha for ₹4,41,054.50 through RTGS from Axis Bank Current A/c towards outstanding due.

Debit Ledger : Sagar Traders,Odisha A/c

In Traditional Approach - Sagar Traders,Odisha A/c is under type Personal Account - Receiver.

In Modern Approach - Sagar Traders,Odisha A/c is under type Liability Account - Decreases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 152)

Amount paid towards salary for the month of Nov’ 2021 for ₹10,000/-.

Debit Ledger : Salary A/c

In Traditional Approach - Salary A/c is under type Nominal Account - Expense.

In Modern Approach - Salary A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 153)

Amount paid to Mr. Rakesh Das towards rent for the month of Nov’ 2021 for ₹4,000/-.

Debit Ledger : Rent A/c

In Traditional Approach - Rent A/c is under type Nominal Account - Expense.

In Modern Approach - Rent A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 154)

Amount paid to Lotus Stationery Shop towards office stationery for ₹205/- as per CM No-605.

Debit Ledger : Printing & Stationery A/c

In Traditional Approach - Printing & Stationery A/c is under type Nominal Account - Expense.

In Modern Approach - Printing & Stationery A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 155)

Amount paid to United India Insurance Company Ltd towards Motor Cycle insurance for ₹1,760/- from dt.01/12/2021 to dt.30/11/2022.

Debit Ledger : Insurance A/c

In Traditional Approach - Insurance A/c is under type Nominal Account - Expense.

In Modern Approach - Insurance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 156)

Amount paid towards staff food expenses for ₹4,600/-.

Debit Ledger : Staff Food Expenses A/c

In Traditional Approach - Staff Food Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Staff Food Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

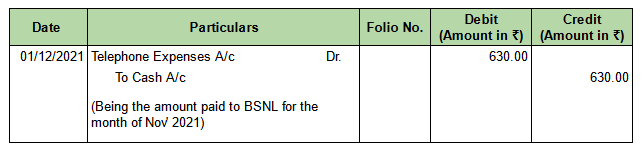

Date : 01/12/2021 (Transaction No. 157)

Amount paid to BSNL for ₹630/- towards telephone bill for the month of Nov’ 2021.

Debit Ledger : Telephone Expenses A/c

In Traditional Approach - Telephone Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Telephone Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 158)

Amount paid towards petrol for vehicle for ₹170/-.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 159)

Goods purchased from Ambica Agency, Odisha for ₹4,89,475.80 as per Invoice No-EM/723/21-22.

Item/Product/Taxable Value ₹4,14,810/-, CGST ₹37,332.90 and SGST ₹37,332.90

Total Invoice Value is ₹4,89,475.80(i.e Taxable Value ₹4,14,810 + CGST ₹37,332.90 + SGST ₹37,332.90).

Debit Ledgers are :

Purchases A/c

CGST A/c

SGST A/c

In Traditional Approach :

Purchases A/c is under type Nominal Account - Expense.

CGST A/c is under type Personal Account - Receiver.

SGST A/c is under type Personal Account - Receiver.

In Modern Approach :

Purchases A/c is under type Asset Account - Increase.

CGST A/c is under type Asset Account - Increase.

SGST A/c is under type Asset Account - Increase.

Credit Ledger : Ambica Agency,Odisha A/c

In Traditional Approach - Ambica Agency, Odisha A/c is under Personal Account - Giver.

In Modern Approach - Ambica Agency, Odisha A/c is under Liability Account - Increases.

Journal Entry

Click here to know how to enter the above Purchase Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 160)

Amount paid to ABC Roadways vide chq no-700113 for ₹3,111/- from Axis Bank Current A/c towards transportation charges for above purchases.

Debit Ledger : Carriage & Freight A/c

In Traditional Approach - Carriage & Freight A/c is under type Nominal Account - Expense.

In Modern Approach - Carriage & Freight A/c is under type Expense Account - Increases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/12/2021 (Transaction No. 161)

Goods sold to Radhakrishna Enterprises, Odisha as per Invoice No-11 for ₹7,52,510.88

Item/Product/Taxable Value ₹6,39,144/-, CGST ₹56,683.44 and SGST ₹56,683.44

Total Invoice Value is ₹7,52,510.88(i.e Taxable Value ₹6,39,144 + CGST ₹56,683.44 + SGST ₹56,683.44).

See the Invoice details below.

Debit Ledger : Radhakrishna Enterprises,Odisha A/c

In Traditional Approach :

Radhakrishna Enterprises,Odisha A/c is under type Personal Account - Receiver.

In Modern Approach :

Radhakrishna Enterprises,Odisha A/c is under type Asset Account - Increase.

Credit Ledgers are :

Sales A/c

CGST A/c

SGST A/c

In Traditional Approach :

Sales A/c is under type Nominal Account - Income.

CGST A/c is under type Personal Account - Giver.

SGST A/c is under type Personal Account - Giver.

In Modern Approach :

Sales A/c is under type Revenue Account - Increase.

CGST A/c is under type Liability Account - Increase.

SGST A/c is under type Liability Account - Increase.

Journal Entry

Click here to know how to enter the above Sales Voucher in TallyPrime.

Date : 02/12/2021 (Transaction No. 162)

₹6,000/- paid to proprietor towards his personal expenses.

Debit Ledger : Drawings A/c

In Traditional Approach - Drawings A/c is under type Personal Account - Receiver.

(Note : Drawings Account is considered as Personal Account because in Proprietorship Firm Accounting 'Drawings Account' is a sub-ledger of Capital Account).

In Modern Approach - Drawings A/c is under type Capital Account - decreases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/12/2021 (Transaction No. 163)

Amount paid to Lotus Stationery Shop towards office stationery for ₹125/- as per CM No-714.

Debit Ledger : Printing & Stationery A/c

In Traditional Approach - Printing & Stationery A/c is under type Nominal Account - Expense.

In Modern Approach - Printing & Stationery A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/12/2021 (Transaction No. 164)

Amount paid to CESU towards electric bill for ₹466/- for the month of Nov’ 2021.

Debit Ledger : Electricity Charges A/c

In Traditional Approach - Electricity Charges A/c is under type Nominal Account - Expense.

In Modern Approach - Electricity Charges A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/12/2021 (Transaction No. 165)

Amount paid to Mr. Ajit Patel for ₹1,542/-towards market visit.

Debit Ledger : Travelling Expenses A/c

In Traditional Approach - Travelling Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Travelling Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/12/2021 (Transaction No. 166)

Amount paid to Chiku Garage towards vehicle repairing for ₹210/-.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/12/2021 (Transaction No. 167)

Goods sold to Maa Electrical Pvt. Ltd, Odisha for ₹8,98,621.92 as per Invoice No-12.

Item/Product/Taxable Value ₹7,61,544/-, CGST ₹68,538.96 and SGST ₹68,538.96

Total Invoice Value is ₹8,98,621.92(i.e Taxable Value ₹7,61,544 + CGST ₹68,538.96 + SGST ₹68,538.96).

See the Invoice details below.

Debit Ledger : Maa Electricals Pvt. Ltd, Odisha A/c

In Traditional Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Personal Account - Receiver.

In Modern Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Asset Account - Increase.

Credit Ledgers are :

Sales A/c

CGST A/c

SGST A/c

In Traditional Approach :

Sales A/c is under type Nominal Account - Income.

CGST A/c is under type Personal Account - Giver.

SGST A/c is under type Personal Account - Giver.

In Modern Approach :

Sales A/c is under type Revenue Account - Increase.

CGST A/c is under type Liability Account - Increase.

SGST A/c is under type Liability Account - Increase.

Journal Entry

Click here to know how to enter the above Sales Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 168)

Amount paid to Mr. Rakesh Das towards Rent for the month of Dec’ 2021 for ₹4,000/-.

Debit Ledger : Rent A/c

In Traditional Approach - Rent A/c is under type Nominal Account - Expense.

In Modern Approach - Rent A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 169)

Amount paid to Trupti Xerox towards xerox charges for ₹85/-.

Debit Ledger : Printing & Stationery A/c

In Traditional Approach - Printing & Stationery A/c is under type Nominal Account - Expense.

In Modern Approach - Printing & Stationery A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 170)

Amount paid to Sriguru Printing Press for ₹1,802/- towards Printing of New Year Calender as per Bill No-1820.

Debit Ledger : Advertisement Expenses A/c

In Traditional Approach - Advertisement Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Advertisement Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

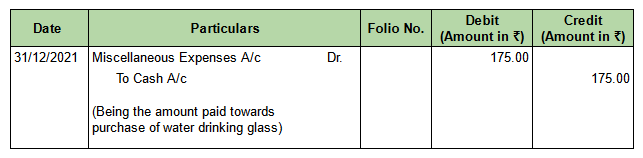

Date : 31/12/2021 (Transaction No. 171)

Amount paid towards water drinking glass for ₹175/-.

Debit Ledger : Miscellaneous Expenses A/c

In Traditional Approach - Miscellaneous Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Miscellaneous Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 172)

Amount paid towards medicine for staff for ₹730/-.

Debit Ledger : Staff Welfare Expenses A/c

In Traditional Approach - Staff Welfare Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Staff Welfare Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 173)

Amount paid to Mr. Ajit Patel towards market visit for ₹1,705/-.

Debit Ledger : Travelling Expenses A/c

In Traditional Approach - Travelling Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Travelling Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 174)

Amount paid towards petrol for vehicle for ₹125/-.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 175)

Amount Received from Radhakrishna Enterprises, Odisha vide Chq No-725304 for ₹6,89,801.66 and deposited into Axis Bank Current A/c towards outstanding due.

Debit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under type Real Account - Comes in.

In Modern Approach - Axis Bank Current A/c is under type Asset Account - Increases.

Credit Ledger : Radhakrishna Enterprises,Odisha A/c

In Traditional Approach - Radhakrishna Enterprises,Odisha A/c is under Personal Account - Giver.

In Modern Approach - Radhakrishna Enterprises,Odisha A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Receipt Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 176)

₹3,00,000/- received from Maa Electrical Pvt. Ltd, Odisha vide Chq No-507875 and deposited into Axis Bank Current A/c towards outstanding due.

Debit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under type Real Account - Comes in.

In Modern Approach - Axis Bank Current A/c is under type Asset Account - Increases.

Credit Ledger : Maa Electricals Pvt.Ltd,Odisha A/c

In Traditional Approach - Maa Electricals Pvt.Ltd,Odisha A/c is under Personal Account - Giver.

In Modern Approach - Maa Electricals Pvt.Ltd,Odisha A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Receipt Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 177)

Goods purchased from Ambica Agency, Odisha for ₹37,464.20 as per Invoice No-EM/795/21-22.

Item/Product/Taxable Value ₹33,185/-, CGST ₹2,139.60 and SGST ₹2,139.60

Total Invoice Value is ₹37,464.20(i.e Taxable Value ₹33,185 + CGST ₹2,139.60 + SGST ₹2,139.60).

See the Invoice details below.

Debit Ledgers are :Purchases A/c

CGST A/c

SGST A/c

In Traditional Approach :

Purchases A/c is under type Nominal Account - Expense.

CGST A/c is under type Personal Account - Receiver.

SGST A/c is under type Personal Account - Receiver.

In Modern Approach :

Purchases A/c is under type Asset Account - Increase.

CGST A/c is under type Asset Account - Increase.

SGST A/c is under type Asset Account - Increase.

Credit Ledger : Ambica Agency,Odisha A/c

In Traditional Approach - Ambica Agency, Odisha A/c is under Personal Account - Giver.

In Modern Approach - Ambica Agency, Odisha A/c is under Liability Account - Increases.

Journal Entry

Click here to know how to enter the above Purchase Voucher in TallyPrime.

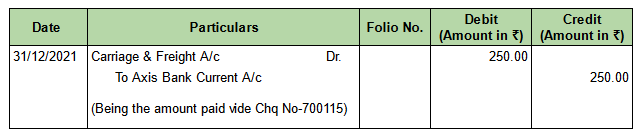

Date : 31/12/2021 (Transaction No. 178)

Amount paid ABC Roadways vide Chq No-700115 from Axis Bank Current Account for ₹250/- towards transportation charges for above purchase.

Debit Ledger : Carriage & Freight A/c

In Traditional Approach - Carriage & Freight A/c is under type Nominal Account - Expense.

In Modern Approach - Carriage & Freight A/c is under type Expense Account - Increases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/12/2021 (Transaction No. 179)

Amount paid to Ambica Agency, Odisha for ₹37,464.20 vide Chq No-700114 from Axis Bank Current A/c towards outstanding due.

Debit Ledger : Ambica Agency, Odisha A/c

In Traditional Approach - Ambica Agency, Odisha A/c is under type Personal Account - Receiver.

In Modern Approach - Ambica Agency, Odisha A/c is under type Liability Account - Decreases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

View Reports in TallyPrime Accounting Software.

One can view different Reports like Ledger Statements, Trial Balance, Profit & Loss Account, Balance Sheet etc. at any time for any period.

1) Let's View Trial Balance as on date 31/12/2021

Follow these steps.

On 'Gateway of Tally' Screen

Press 'D' or select and press 'Enter Key' on 'Display More Reports'

Press 'T' or select and press 'Enter Key' on 'Trial Balance'

Press 'F2' or click on 'F2:Period' to select Period (from date 01/04/2021 to date 31/12/2021)

After entry the required date range, press 'Enter Key'Press 'Alt+F1' to view Trial Balance in detail format(Group with Ledger Wise)

The above image is the Final view of Trial Balance from date 01/04/2021 to 31/12/2021.

2) Let's View Profit & Loss Account as on date 31/12/2021

Follow these steps.

On 'Gateway of Tally' Screen

Press 'P' or select and press 'Enter Key' on 'Profit & Loss A/c'

Press 'F2' or click on 'F2:Period' to select Period (from date 01/04/2021 to date 31/12/2021)

After entry the required date range, press 'Enter Key'

Press 'Alt+F1' to view Profit & Loss A/c in details.

The above image is the Final view of Profit & Loss Account from date 01/04/2021 to 31/12/2021.

3) Let's View Balance Sheet as on date 31/12/2021

Follow these steps.

On 'Gateway of Tally' Screen

Press 'B' or select and press 'Enter Key' on 'Balance Sheet'

Press 'F2' or click on 'F2:Period' to select Period (from date 01/04/2021 to date 31/12/2021)

After entry the required date range, press 'Enter Key'

Press 'Alt+F1' to view Balance Sheet in details.

The above image is the Final view of Balance Sheet from date 01/04/2021 to 31/12/2021.

Related Articles :

Double Entry System of Book Keeping

Comments

Post a Comment