Practice Sheet - 12 of 12 (Transactions for the month of March' 2022)

Students/learners can get benefit and complete knowledge on this Practical Project after completion of all the 12 Practice Sheets with a proper sequence.

Let's Practice the below mentioned transactions of a Business Unit to be more confident on Decision making for Debiting and Crediting of Ledger Accounts with Journal Entries. This practice sheet is prepared in such a way that one can gain complete knowledge about the procedure of Financial Accounting from Journal Entry to Final Accounts.

TRIMURTHY TRADERS

(Prop : Mr. Surya Krishnamurthy)

Financial Year : 2021-22(April' 2021 to March' 2022)

Assessment Year : 2022-23(April' 2022 to March' 2023)

Date : 01/03/2022 (Transaction No. 222)

Amount paid to SPN Electrical Pvt. Ltd, Maharastra for ₹5,98,700/- through RTGS from Axis Bank Current A/c towards outstanding due.

Debit Ledger : SPN Electrical Pvt. Ltd, Maharastra A/c

In Traditional Approach - SPN Electrical Pvt. Ltd, Maharastra A/c is under type Personal Account - Receiver.

In Modern Approach - SPN Electrical Pvt. Ltd, Maharastra A/c is under type Liability Account - Decreases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 223)

Amount paid to proprietor for ₹6,000/- towards his personal expenses.

Debit Ledger : Drawings A/c

In Traditional Approach - Drawings A/c is under type Personal Account - Receiver.

(Note : Drawings Account is considered as Personal Account because in Proprietorship Firm Accounting 'Drawings Account' is a sub-ledger of Capital Account).

- In Modern Approach - Drawings A/c is under type Capital Account - decreases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 224)

Amount paid for ₹10,000/- towards salary for the month of Feb’ 2022.

Debit Ledger : Salary A/c

In Traditional Approach - Salary A/c is under type Nominal Account - Expense.

In Modern Approach - Salary A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 225)

Amount paid to Lily Book Store as per CM No-2997 towards purchase of office stationery for ₹115/-.

Debit Ledger : Printing & Stationery A/c

In Traditional Approach - Printing & Stationery A/c is under type Nominal Account - Expense.

In Modern Approach - Printing & Stationery A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 226)

Amount paid to CESU for ₹453/- towards electric bill for the month of Feb’ 2022.

Debit Ledger : Electricity Charges A/c

In Traditional Approach - Electricity Charges A/c is under type Nominal Account - Expense.

In Modern Approach - Electricity Charges A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 227)

₹4,600/- paid towards staff food expenses.

Debit Ledger : Staff Food Expenses A/c

In Traditional Approach - Staff Food Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Staff Food Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 228)

Amount paid towards petrol for vehicle for ₹163/-.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 229)

Amount received from Radhakrishna Enterprises, Odisha for ₹1,90,000/- through NEFT to Axis Bank Current A/c towards outstanding due and allowed discount for ₹1,282.30

Debit Ledgers are :

Axis Bank Current A/c

Discount Allowed A/c

In Traditional Approach - Axis Bank Current A/c is under type Real Account - Comes in.

In Traditional Approach - Discount Allowed A/c is under type Nominal Account -Expense.

In Modern Approach - Axis Bank Current A/c is under type Asset Account - Increases.

In Modern Approach - Discount Allowed A/c is under type Expense Account - Increases.

Credit Ledger : Radhakrishna Enterprises,Odisha A/c

In Traditional Approach - Radhakrishna Enterprises,Odisha A/c is under Personal Account - Giver.

In Modern Approach - Radhakrishna Enterprises,Odisha A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Receipt Voucher in TallyPrime.

Date : 01/03/2022 (Transaction No. 230)

Goods sold to Maa Electrical Pvt. Ltd, Odisha for ₹1,29,870.72 as per Invoice No-17.

Item/Product/Taxable Value ₹1,10,664/-, CGST ₹9,603.36 and SGST ₹9,603.36

Total Invoice Value is ₹1,29,870.72(i.e Taxable Value ₹1,10,664 + CGST ₹9,603.36 + SGST ₹9,603.36).

See the Invoice details below.

Debit Ledger : Maa Electricals Pvt. Ltd, Odisha A/c

In Traditional Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Personal Account - Receiver.

In Modern Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Asset Account - Increase.

Credit Ledgers are :

Sales A/c

CGST A/c

SGST A/c

In Traditional Approach :

Sales A/c is under type Nominal Account - Income.

CGST A/c is under type Personal Account - Giver.

SGST A/c is under type Personal Account - Giver.

In Modern Approach :

Sales A/c is under type Revenue Account - Increase.

CGST A/c is under type Liability Account - Increase.

SGST A/c is under type Liability Account - Increase.

Journal Entry

Click here to know how to enter the above Sales Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 231)

Amount paid to SPN Electrical Pvt. Ltd, Maharastra for ₹7,31,110/- through RTGS from Axis Bank Current A/c towards outstanding due.

Debit Ledger : SPN Electrical Pvt. Ltd, Maharastra A/c

In Traditional Approach - SPN Electrical Pvt. Ltd, Maharastra A/c is under type Personal Account - Receiver.

In Modern Approach - SPN Electrical Pvt. Ltd, Maharastra A/c is under type Liability Account - Decreases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 232)

Amount paid to Mr. Rakesh Das towards Rent for the month of Feb’ 2022 for ₹4,000/-.

Debit Ledger : Rent A/c

In Traditional Approach - Rent A/c is under type Nominal Account - Expense.

In Modern Approach - Rent A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 233)

Amount paid to BSNL for ₹630/- towards telephone bill for the month of Feb’ 2022.

Debit Ledger : Telephone Expenses A/c

In Traditional Approach - Telephone Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Telephone Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 234)

Amount paid to Mr. Ajit Patel for ₹1,285/- towards market visit.

Debit Ledger : Travelling Expenses A/c

In Traditional Approach - Travelling Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Travelling Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 235)

Amount paid towards petrol for vehicle for ₹210/-.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 236)

₹7,500/- paid towards Advance Income Tax for the A.Y-2022-23 vide e-challan No-INB0523246 from Axis Bank Current Account.

Debit Ledger : Advance Income Tax A/c

In Traditional Approach - Advance Income Tax A/c is under type Personal Account - Receiver.

In Modern Approach - Advance Income Tax A/c is under type Asset Account - Increases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 237)

Goods sold to Chand Enterprises Pvt. Ltd, Delhi for ₹5,26,399.20 as per Invoice No-18.

Item/Product/Taxable Value ₹4,24,440/-, IGST ₹1,01,959.20

Total Invoice Value is ₹5,26,399.20(i.e Taxable Value ₹4,24,440 + IGST ₹1,01,959.20).

See the Invoice details below.

Debit Ledger : Chand Enterprises Pvt. Ltd, Delhi A/c

In Traditional Approach :

Chand Enterprises Pvt. Ltd, Delhi A/c is under type Personal Account - Receiver.

In Modern Approach :

Chand Enterprises Pvt. Ltd, Delhi A/c is under type Asset Account - Increase.

Credit Ledgers are :

Sales A/c

IGST A/c

In Traditional Approach :

Sales A/c is under type Nominal Account - Income.

IGST A/c is under type Personal Account - Giver.

In Modern Approach :

Sales A/c is under type Revenue Account - Increase.

IGST A/c is under type Liability Account - Increase.

Journal Entry

Click here to know how to enter the above Sales Voucher in TallyPrime.

Date : 02/03/2022 (Transaction No. 238)

Amount charged by Axis Bank Current Account for ₹147/- towards service charges.

Debit Ledger : Bank Charges A/c

In Traditional Approach - Bank Charges A/c is under type Nominal Account - Expense.

In Modern Approach - Bank Charges A/c is under type Expense Account - Increases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 239)

Amount paid to Mr. Rakesh Das towards Rent for the month of March’ 2022 for ₹4,000/-.

Debit Ledger : Rent A/c

In Traditional Approach - Rent A/c is under type Nominal Account - Expense.

In Modern Approach - Rent A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 240)

Amount paid to Lily Book Store as per CM No-3215 towards purchase of office stationery for ₹233/-.

Debit Ledger : Printing & Stationery A/c

In Traditional Approach - Printing & Stationery A/c is under type Nominal Account - Expense.

In Modern Approach - Printing & Stationery A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 241)

₹4,600/- paid towards staff food expenses.

Debit Ledger : Staff Food Expenses A/c

In Traditional Approach - Staff Food Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Staff Food Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 242)

Amount paid towards petrol for vehicle for ₹110/-.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 243)

Interest charged on HDFC Bank Cash Credit Account by bank for ₹39,093/-.

Debit Ledger : Interest on Bank Loan A/c

In Traditional Approach - Interest on Bank Loan A/c is under type Nominal Account - Expense.

In Modern Approach - Interest on Bank Loan A/c is under type Expense Account - Increases.

Credit Ledger : HDFC Bank(Cash Credit) A/c

In Traditional Approach - HDFC Bank(Cash Credit) A/c is under Real Account - Goes Out.

In Modern Approach - HDFC Bank(Cash Credit) A/c is under Liability Account - Increases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 244)

Goods sold to Jagannath Sales, Odisha for ₹4,69,517.28 as per Invoice No-19.

Item/Product/Taxable Value ₹4,04,916/-, CGST ₹32,300.64 and SGST ₹32,300.64

Total Invoice Value is ₹4,69,517.28(i.e Taxable Value ₹4,04,916 + CGST ₹32,300.64 + SGST ₹32,300.64).

See the Invoice details below.

Debit Ledger : Jagannath Sales, Odisha A/c

In Traditional Approach :

Jagannath Sales, Odisha A/c is under type Personal Account - Receiver.

In Modern Approach :

Jagannath Sales, Odisha A/c is under type Asset Account - Increase.

Credit Ledgers are :

Sales A/c

CGST A/c

SGST A/c

In Traditional Approach :

Sales A/c is under type Nominal Account - Income.

CGST A/c is under type Personal Account - Giver.

SGST A/c is under type Personal Account - Giver.

In Modern Approach :

Sales A/c is under type Revenue Account - Increase.

CGST A/c is under type Liability Account - Increase.

SGST A/c is under type Liability Account - Increase.

Journal Entry

Click here to know how to enter the above Sales Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 245)

Amount received from Jagannath Sales, Odisha for ₹4,69,517.28 by RTGS to HDFC Bank Cash Credit Account towards outstanding due.

Debit Ledger : HDFC Bank(Cash Credit) A/c

In Traditional Approach - HDFC Bank(Cash Credit) A/c is under type Real Account - Comes in.

In Modern Approach - HDFC Bank(Cash Credit) A/c is under type Liability Account - decreases.

Credit Ledger : Jagannath Sales,Odisha A/c

In Traditional Approach - Jagannath Sales,Odisha A/c is under Personal Account - Giver.

In Modern Approach - Jagannath Sales,Odisha A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Receipt Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 246)

Amount received from Chand Enterprises Pvt. Ltd, Delhi vide Chq No-102425 for ₹4,82,532.60 and deposited into HDFC Bank Cash Credit A/c towards outstanding due.

Debit Ledger : HDFC Bank(Cash Credit) A/c

In Traditional Approach - HDFC Bank(Cash Credit) A/c is under type Real Account - Comes in.

In Modern Approach - HDFC Bank(Cash Credit) A/c is under type Liability Account - decreases.

Credit Ledger : Chand Enterprises Pvt. Ltd, Delhi A/c

In Traditional Approach - Chand Enterprises Pvt. Ltd, Delhi A/c is under Personal Account - Giver.

In Modern Approach - Chand Enterprises Pvt. Ltd, Delhi A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Receipt Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 247)

Salary for the month of March for ₹10,000/- incurred but not yet paid.

Debit Ledger : Salary A/c

In Traditional Approach - Salary A/c is under type Nominal Account - Expense.

In Modern Approach - Salary A/c is under type Expense Account - Increases.

Credit Ledger : Salary Payable A/c

In Traditional Approach - Salary Payable A/c is under type Personal Account - Giver.

In Modern Approach - Salary Payable A/c is under type Liability Account - Increases.

Journal Entry

Click here to know how to enter the above Journal Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 248)

₹6,750/- credited by Axis Bank to Fixed Deposit A/c towards interest on FD after ITDS(Income Tax Deducted at Source) for ₹750/-.

Debit Ledgers are :

Fixed Deposit with Axis Bank A/c

TDS A/c

In Traditional Approach :

Fixed Deposit with Axis Bank A/c is under type Real Account - Comes in.

TDS A/c is under type Personal Account - Receiver

In Modern Approach :

Fixed Deposit with Axis Bank A/c is under type Asset Account -Increases.

TDS A/c is under type Asset Account - Increases.

Credit Ledger : Interest on FD A/c

In Traditional Approach - Interest on FD A/c is under type Nominal Account - Income.

In Modern Approach - Interest on FD A/c is under type Revenue Account - Increases.

Journal Entry

Click here to know how to enter the above Journal Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 249)

Credit Note No-1 for ₹10,644.48 issued to Maa Electrical Pvt. Ltd, Odisha towards goods return against Inv No-17 dt.01/03/2022.

See the Credit Note details below.

Debit Ledgers are :

Sales Return A/c

CGST A/c

SGST A/c

In Traditional Approach :

Sales Return A/c is under type Nominal Account - Expense(Opposite Account of Sales Account).

CGST A/c is under type Personal Account - Receiver.

SGST A/c is under type Personal Account - Receiver.

In Modern Approach :

Sales Return A/c is under type Expense Account - Increase.

CGST A/c is under type Liability Account - decrease.

SGST A/c is under type Liability Account - decrease.

Credit Ledger : Maa Electricals Pvt. Ltd, Odisha A/c

In Traditional Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Personal Account - Giver.

In Modern Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Asset Account - decrease.

Journal Entry

Click here to know how to enter the above Credit Note Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 250)

Amount paid to Advocate Basudev Nayak towards consultancy fees on Legal matters for ₹4,850/-.

Debit Ledger : Legal Expenses A/c

In Traditional Approach - Legal Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Legal Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 251)

Chq No-203510 for Rs.50,000/- received from Govind Electrical Traders, West Bengal against Inv No-13 dt.02/01/2022 towards outstanding due not yet deposited into Bank.

Debit Ledger : Cheques in Hand A/c

In Traditional Approach - Cheques in Hand A/c is under Real Account - Comes in.

In Modern Approach - Cheques in Hand A/c is under type Asset Account - Increases.

Credit Ledger : Govind Electrical Traders, West Bengal A/c

In Traditional Approach - Govind Electrical Traders, West Bengal A/c is under Personal Account - Giver.

In Modern Approach - Govind Electrical Traders, West Bengal A/c is under Asset Account - Decreases.

Journal Entry

Click here to know how to enter the above Receipt Voucher in TallyPrime.

Date : 31/03/2022 (Transaction No. 252)

Depreciation charged on Fixed Assets : 40% on Computer, 10% on Furniture & Fixture, 15% on Motor Cycle.

Debit Ledger : Depreciation A/c

In Traditional Approach - Depreciation A/c is under type Nominal Account - Loss.

In Modern Approach - Depreciation A/c is under type Expense Account - Increases.

Credit Ledgers are :

Computer A/c

Furniture & Fixture A/c

Motor Cycle A/c

In Traditional Approach -

Computer A/c is under type Real Account - Goes out.

Furniture & Fixture A/c is under type Real Account - Goes out.

Motor Cycle A/c is under type Real Account - Goes out.

In Modern Approach

Computer A/c is under type Asset Account - decreases

Furniture & Fixture A/c is under type Asset Account - decreases.

Motor Cycle A/c is under type Real Account - decreases.

Journal Entry

Click here to know how to enter the above Journal Voucher in TallyPrime.

View Reports in TallyPrime Accounting Software.

One can view different Reports like Ledger Statements, Trial Balance, Profit & Loss Account, Balance Sheet etc. at any time for any period.

1) Let's View Trial Balance as on date 31/03/2022

Follow these steps.

On 'Gateway of Tally' Screen

Press 'D' or select and press 'Enter Key' on 'Display More Reports'

Press 'T' or select and press 'Enter Key' on 'Trial Balance'

Press 'Alt+F1' to view Trial Balance in detail format(Ledger Wise)

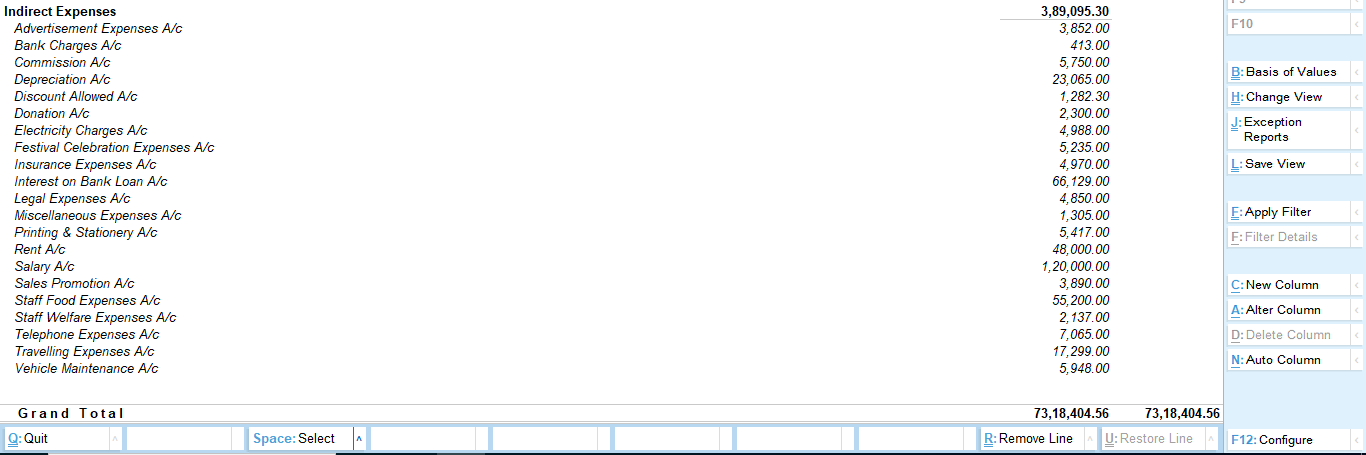

2) Let's View Profit & Loss Account as on date 31/03/2022

Follow these steps.

On 'Gateway of Tally' Screen

Press 'P' or select and press 'Enter Key' on 'Profit & Loss A/c'

Press 'Alt+F1' to view Profit & Loss A/c in detail.The above image is the Final view of Profit & Loss Account from date 01/04/2021 to 31/03/2022.

3) Let's View Balance Sheet as on date 31/03/2022

Follow these steps.

On 'Gateway of Tally' Screen

Press 'B' or select and press 'Enter Key' on 'Balance Sheet'

Press 'Alt+F1' to view Balance Sheet in details.

Related Articles :

Double Entry System of Book Keeping

Comments

Post a Comment