Practice Sheet - 6 of 12 (Transactions for the month of Sep' 2021)

Students/learners can get benefit and complete knowledge on this Practical Project after completion of all the 12 Practice Sheets with a proper sequence.

Let's Practice the below mentioned transactions of a Business Unit to be more confident on Decision making for Debiting and Crediting of Ledger Accounts with Journal Entries. This practice sheet is prepared in such a way that one can gain complete knowledge about the procedure of Financial Accounting from Journal Entry to Final Accounts.

TRIMURTHY TRADERS

(Prop : Mr. Surya Krishnamurthy)

Financial Year : 2021-22(April' 2021 to March' 2022)

Assessment Year : 2022-23(April' 2022 to March' 2023)

Date :01/09/2021 (Transaction No. 95)

Amount paid to Proprietor for ₹6,000/- towards his personal expenses.

Debit Ledger : Drawings A/c

In Traditional Approach - Drawings A/c is under type Personal Account - Receiver.

(Note : Drawings Account is considered as Personal Account because in Proprietorship Firm Accounting 'Drawings Account' is a sub-ledger of Capital Account).

In Modern Approach - Drawings A/c is under type Capital Account - decreases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime

Date : 01/09/2021 (Transaction No. 96)

Amount paid towards Salary for the month of Aug’ 2021 for ₹10,000/-.

Debit Ledger : Salary A/c

In Traditional Approach - Salary A/c is under type Nominal Account - Expense.

In Modern Approach - Salary A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime

Date : 01/09/2021 (Transaction No. 97)

Amount paid to Mr. Rakesh Das towards Rent for ₹4,000/- for the month of Aug’ 2021.

Debit Ledger : Rent A/c

In Traditional Approach - Rent A/c is under type Nominal Account - Expense.

In Modern Approach - Rent A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime

Date : 01/09/2021 (Transaction No. 98)

Amount paid to Lotus Stationery Shop for ₹130/- as per CM No-286 towards office stationery.

Debit Ledger : Printing & Stationery A/c

In Traditional Approach - Printing & Stationery A/c is under type Nominal Account - Expense.

In Modern Approach - Printing & Stationery A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime

Date : 01/09/2021 (Transaction No. 99)

₹160/- paid towards petrol for vehicle.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime

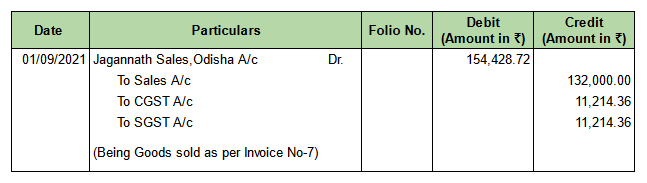

Date : 01/09/2021 (Transaction No. 100)

Goods sold to Jagannath Sales, Odisha as per Invoice No-7 for ₹1,54,428.72

Item/Product/Taxable Value ₹1,32,000/-, CGST ₹11,214.36 and SGST ₹11,214.36

Total Invoice Value is ₹1,54,428.72(i.e Taxable Value ₹1,32,000 + CGST ₹11,214.36 + SGST ₹11,214.36).

See the Invoice details below.

Debit Ledger : Jagannath Sales, Odisha A/c

In Traditional Approach :

Jagannath Sales, Odisha A/c is under type Personal Account - Receiver.

In Modern Approach :

Jagannath Sales, Odisha A/c is under type Asset Account - Increase.

Credit Ledgers are :

Sales A/c

CGST A/c

SGST A/c

In Traditional Approach :

Sales A/c is under type Nominal Account - Income.

CGST A/c is under type Personal Account - Giver.

SGST A/c is under type Personal Account - Giver.

In Modern Approach :

Sales A/c is under type Revenue Account - Increase.

CGST A/c is under type Liability Account - Increase.

SGST A/c is under type Liability Account - Increase.

Journal Entry

Click here to know how to enter the above Sales Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 101)

Amount paid to SJ Printing Services towards xerox charges for ₹89/-.

Debit Ledger : Printing & Stationery A/c

In Traditional Approach - Printing & Stationery A/c is under type Nominal Account - Expense.

In Modern Approach - Printing & Stationery A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 102)

Amount paid to CESU towards electric bill for ₹475/- for the month of Aug’ 2021.

Debit Ledger : Electricity Charges A/c

In Traditional Approach - Electricity Charges A/c is under type Nominal Account - Expense.

In Modern Approach - Electricity Charges A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under type Real Account - Goes Out.

In Modern Approach - Cash A/c is under type Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 103)

₹233/- paid towards tea and tiffin expenses for guest.

Debit Ledger : Miscellaneous Expenses A/c

In Traditional Approach - Miscellaneous Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Miscellaneous Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 104)

₹4,600/- paid towards staff food expenses.

Debit Ledger : Staff Food Expenses A/c

In Traditional Approach - Staff Food Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Staff Food Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 105)

Amount paid to BSNL towards telephone bill for ₹595/- for the month of Aug’ 2021.

Debit Ledger : Telephone Expenses A/c

In Traditional Approach - Telephone Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Telephone Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 106)

Amount paid to Mr.Soumit Saha for ₹1,410/- towards market visit.

Debit Ledger : Travelling Expenses A/c

In Traditional Approach - Travelling Expenses A/c is under type Nominal Account - Expense.

In Modern Approach - Travelling Expenses A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 107)

Amount paid towards petrol for vehicle for ₹190/-.

Debit Ledger : Vehicle Maintenance A/c

In Traditional Approach - Vehicle Maintenance A/c is under type Nominal Account - Expense.

In Modern Approach - Vehicle Maintenance A/c is under type Expense Account - Increases.

Credit Ledger : Cash A/c

In Traditional Approach - Cash A/c is under Real Account - Goes Out.

In Modern Approach - Cash A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 108)

Goods purchased from Krishna Enterprises, Odisha for ₹1,36,703.80 as per Invoice No-1098.

Item/Product/Taxable Value ₹1,16,740/-, CGST ₹9,981.90 and SGST ₹9,981.90

Total Invoice Value is ₹1,36,703.80(i.e Taxable Value ₹1,16,740 + CGST ₹9,981.90 + SGST ₹9,981.90).

See the Invoice details below.

Debit Ledgers are :

Purchases A/c

CGST A/c

SGST A/c

In Traditional Approach :

Purchases A/c is under type Nominal Account - Expense.

CGST A/c is under type Personal Account - Receiver.

SGST A/c is under type Personal Account - Receiver.

In Modern Approach :

Purchases A/c is under type Asset Account - Increase.

CGST A/c is under type Asset Account - Increase.

SGST A/c is under type Asset Account - Increase.

Credit Ledger : Krishna Enterprises A/c

In Traditional Approach - Krishna Enterprises A/c is under Personal Account - Giver.

In Modern Approach - Krishna Enterprises A/c is under Liability Account - Increases.

Journal Entry

Click here to know how to enter the above Purchase Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 109)

Amount paid to ABC Roadways vide Chq No-700109 of Axis Bank Current A/c for ₹875/- for the above purchase.

Debit Ledger : Carriage & Freight A/c

In Traditional Approach - Carriage & Freight A/c is under type Nominal Account - Expense.

In Modern Approach - Carriage & Freight A/c is under type Expense Account - Increases.

Credit Ledger : Axis Bank Current A/c

In Traditional Approach - Axis Bank Current A/c is under Real Account - Goes Out.

In Modern Approach - Axis Bank Current A/c is under Asset Account - decreases.

Journal Entry

Click here to know how to enter the above Payment Voucher in TallyPrime.

Date : 02/09/2021 (Transaction No. 110)

Goods sold to Maa Electrical Pvt. Ltd, Odisha for ₹7,07,228.64 as per Invoice No-8.

Item/Product/Taxable Value ₹5,99,580/-, CGST ₹53,824.32 and SGST ₹53,824.32

Total Invoice Value is ₹7,07,228.64(i.e Taxable Value ₹5,99,580 + CGST ₹53,824.32 + SGST ₹53,824.32).

See the Invoice details below.

Debit Ledger : Maa Electricals Pvt. Ltd, Odisha A/c

In Traditional Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Personal Account - Receiver.

In Modern Approach :

Maa Electricals Pvt. Ltd, Odisha A/c is under type Asset Account - Increase.

Credit Ledgers are :

Sales A/c

CGST A/c

SGST A/c

In Traditional Approach :

Sales A/c is under type Nominal Account - Income.

CGST A/c is under type Personal Account - Giver.

SGST A/c is under type Personal Account - Giver.

In Modern Approach :

Sales A/c is under type Revenue Account - Increase.

CGST A/c is under type Liability Account - Increase.

SGST A/c is under type Liability Account - Increase.

Journal Entry

Click here to know how to enter the above Sales Voucher in TallyPrime.

Related Articles :

Double Entry System of Book Keeping

Comments

Post a Comment