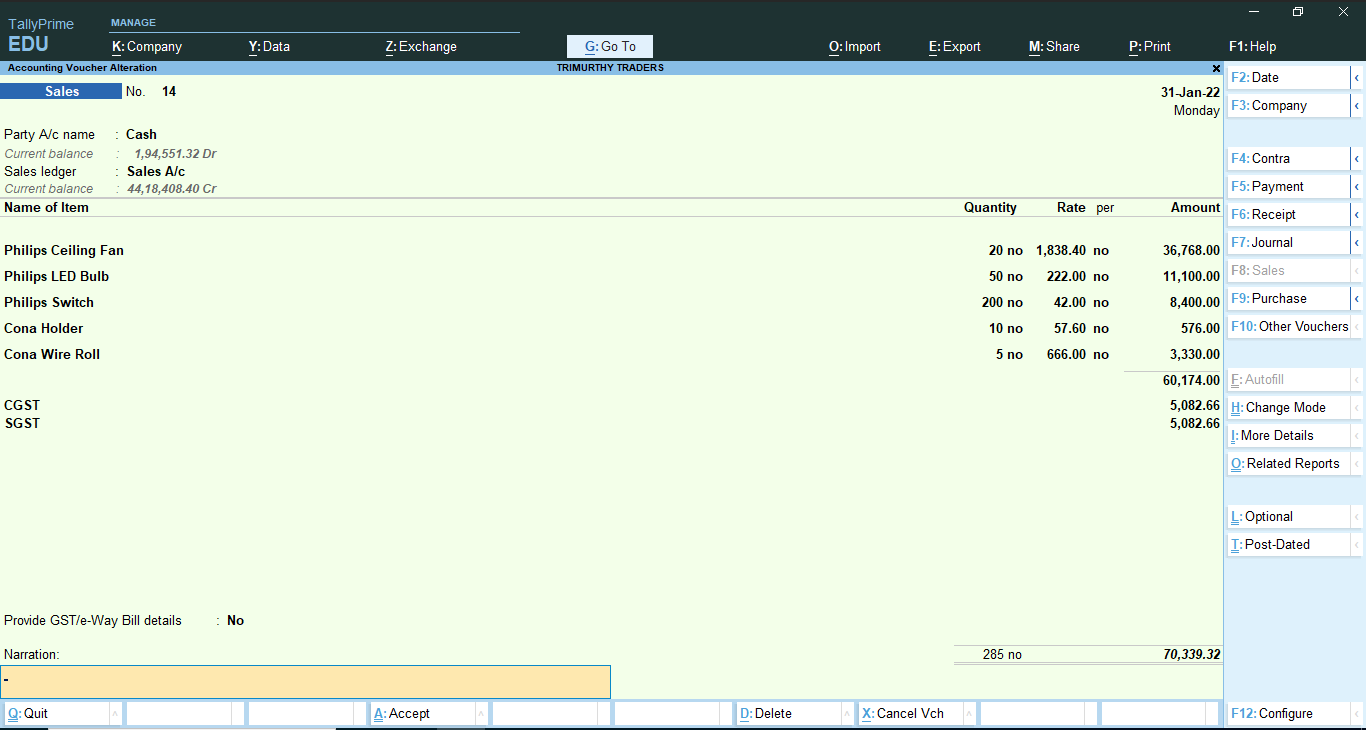

Trimurthy Traders(Proprietor : Mr. Surya Krishnamurthy) - Transaction No.203 of Practice Sheet-10, Sales Voucher No.14 - Entry in TallyPrime

Practice Sheet - 10 (Transactions for the month of Jan' 2022)

TRIMURTHY TRADERS

(Prop : Mr. Surya Krishnamurthy)

Financial Year : 2021-22(April' 2021 to March' 2022)

Assessment Year : 2022-23(April' 2022 to March' 2023)

Date : 31/01/2022 (Transaction No. 203)

Goods sold for Cash ₹70,339.32 to Santoshi Trading Co., Odisha as per Cash Memo/Invoice No-14.

Item/Product/Taxable Value ₹60,174/-, CGST ₹5,082.66 and SGST ₹5,082.66

Total CM/Invoice Value is ₹70,339.32(i.e Taxable Value ₹60,174 + CGST ₹5,082.66 + SGST ₹5,082.66).

See the Cash Memo/Invoice/Bill details below.

Journal Entry

Let's see how to enter the above transaction in TallyPrime.

Steps to enter in TallyPrime.

On GOT Screen, Press 'V' or select and press 'Enter Key' on 'Vouchers'

Press 'F8' or click on 'F8:Sales'

Press 'F2' to enter Date of Voucher/Date of Transaction.

Enter Party A/c Name: 'Cash'

Buyer( Bill to ) : 'Santoshi Trading Co. Odisha A/c'

Sales Ledger: 'Sales A/c'

Stock items and 'CGST & SGST' Ledgers for this Sales Invoice as mentioned in the image below.

Press 'Ctrl+A' to Accept/Save Voucher.

Now Voucher Entry for the above transaction is complete.

Comments

Post a Comment