Practical Accounting Project on Proprietorship Trading Business (T9 PAYV5)

In this Practical Accounting Project, We are learning Journal Entry in all type of Digital Accounting Software, but as the Time constrain and Indian Scenario, we have taken the example of TallyPrime entry with screenshot and references here.

So, anyone can do the same transactions, as refer in this page with TallyPrime, which is also similar or little bit different in screen look only, if you choose any other Accounting Software like Zoho books, QuickBooks, BUSY, Vyapaar , Marg etc and many others.

The Transaction Process, that are given step by step is almost same and perfect for Digital Accounting ecosystem.

Digital Books of Account using TallyPrime

KA DIGITAL WORLD (KADG)

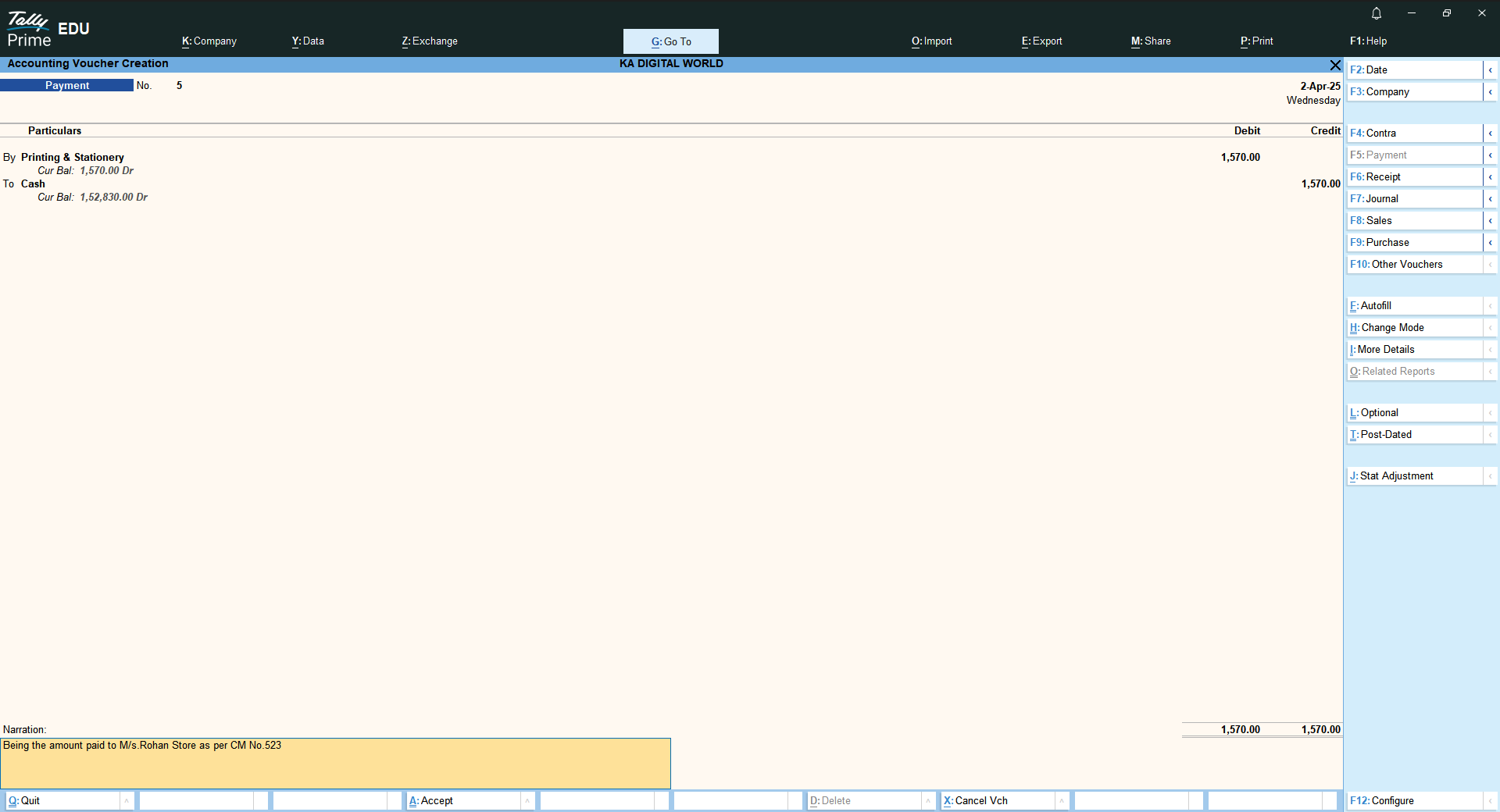

Transaction No.9(T9), Payment Voucher No.5(PAYV5) Entry in TallyPrime

Learning Objective from this Post :

Journal Entry for Cash payment towards Printing & Stationery Expenses.

'Printing & Stationery' Ledger Account Creation under Group 'Indirect Expenses' using TallyPrime

Cash Payment Voucher Entry for Printing & Stationery Expenses using TallyPrime

Business Details with Address

Trade Name : KA DIGITAL WORLD

Financial Year 2025-26, Assessment Year 2026-27

Address : Bhubaneswar, Khurda, Odisha, India, PIN - 751001

Constitution/Style of Business : Proprietorship

Nature of Business : Retail and Wholesale Trading of Computer, parts and accessories.

GSTIN - 21ABDAC5162K1ZM

Transaction No.9

Date : 02/04/2025

Amount paid to M/s.Rohan Store for ₹1,570/- vide cash, as per Cash Memo No.523 towards purchase of Printing paper, Pen, Pencil, Eraser etc.

Journal Entry :

Steps to enter in TallyPrime

On Gateway of Tally Screen,

Press 'V' or select and press 'Enter' on 'Vouchers' (Note : if you are already in Voucher Entry Mode, there is no need to press 'V' and should start from 'F5' function key)

Press 'F5' or click on 'F5:Payment' for Payment Voucher Entry

Press 'F2' or click on 'F2:Date' to enter Date of Voucher/Date of Transaction.

Press 'Alt+C' where 'By/Dr' shows to create 'Printing & Stationery' Ledger Account '' under group 'Indirect Expenses'

Here, purchase of 'Printing & Stationery' is considered as an Indirect Expense because the Nature of Business is Retail and Wholesale Trading of Computer, parts and accessories. Only purchase of Computer, Computer parts and accessories for selling/trading purpose should be treated as Trading Goods. Purchase of goods other than Trading Goods should be taken as either under Fixed Assets or under Direct/Indirect Expenses according to their respective Nature of Expenses.

Place Debit Ledger and Credit Ledger Accounts with amount as shown in the image below.

Press 'Ctrl+A' or 'Y' or 'Enter' to Accept/Save Voucher.

Now Voucher Entry for the above transaction is Complete.

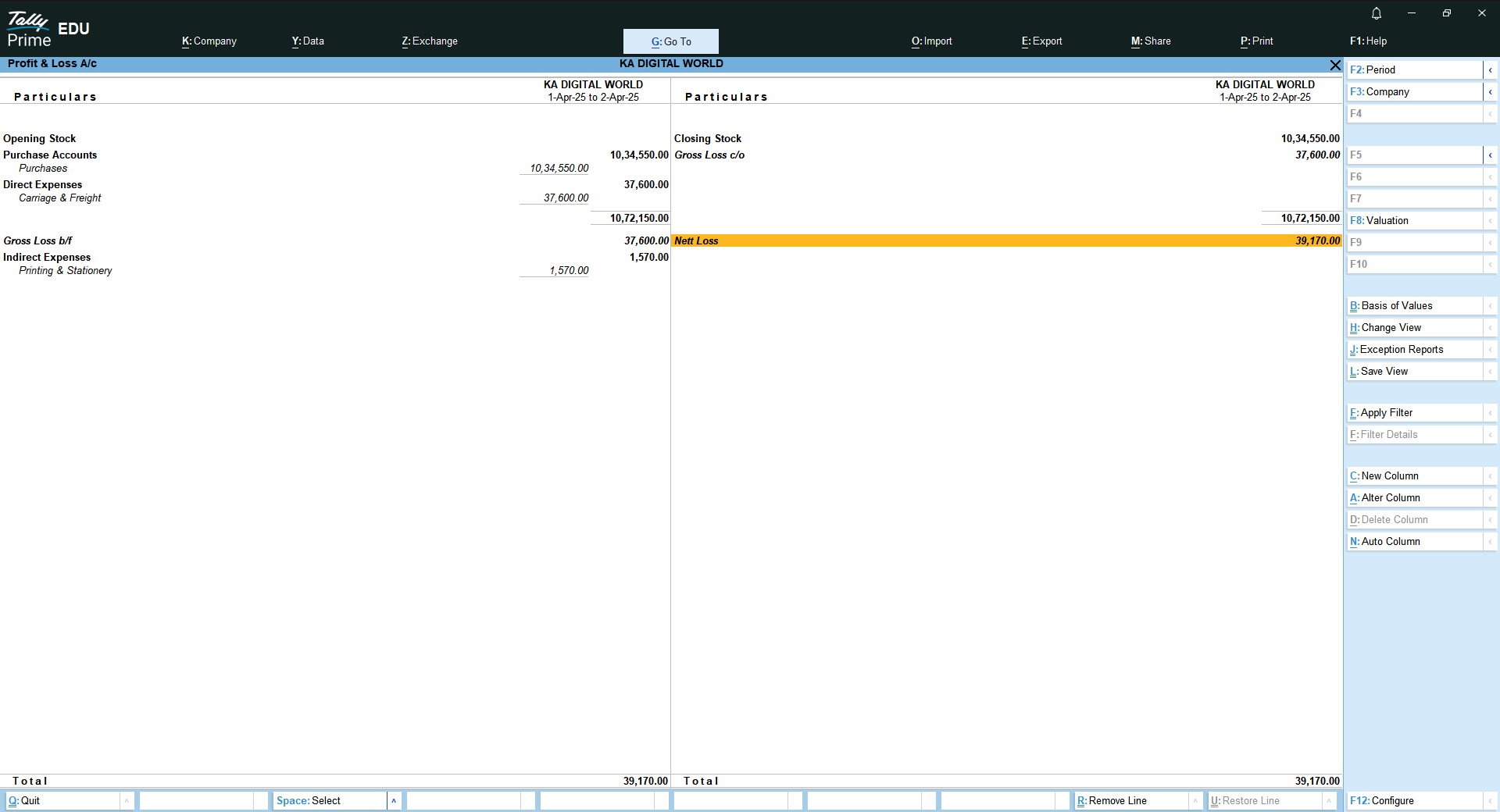

You can check Profit & Loss Account and Balance Sheet after this Voucher Entry..

Profit & Loss Account :

Balance Sheet :

To view and practice all transactions of this project in a proper sequence,

Click this page link : PRACTICAL PROJECTS

Comments

Post a Comment