In a Business organization,

Sometimes purchased goods are returned to the Supplier/Creditor due to reasons like defective goods,excess supply of goods etc.

A brief explanation on Debit and Credit Ledger selection and what Accounting Entry/Journal Entry to be made in the Books of Account.

In case of Cash transaction for Purchase Return,

Cash A/c(in place of Name of the Supplier/Vendor/Creditor) shows Debit effect.

Purchase Return A/c shows Credit effect.

GST/VAT A/c shows Credit effect.

In case of Credit transaction for Purchase Return,

Name of the Supplier/Vendor/Creditor A/c shows Debit effect.

Purchase Return A/c shows Credit effect.

GST/VAT A/c shows Credit effect.

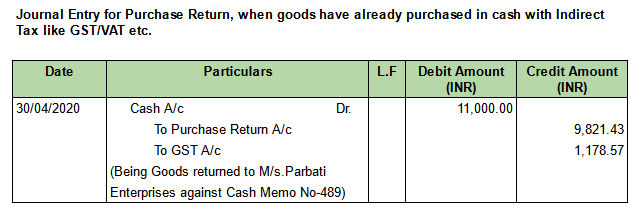

Return of Goods,when Goods have already purchased in Cash with payment of indirect tax like GST/VAT etc.

Let's take an example.

In the Books of Mr.Sanjay Gupta,goods returned to M/s.Parbati Enterprises for ₹11000/- including GST on dated.30/04/2020 and received cash at the immediate effect.

Against purchase value of Cash Memo No-489 for ₹30,499/- including GST@12% on dated.05/04/2020

Steps and Procedures for Decision making for Debiting and Crediting of Ledger Accounts of the above transaction.

Step - 1

In first step,we have to identify the Ledger Accounts involved in the above transaction.

As a result,we found three Ledger Accounts.

1) Cash A/c2) Purchase Return A/c

3) GST A/c(IGST/CGST and SGST are used as per applicability of GST Act.)

Step - 2In second step,we have to find out the type of Ledger Accounts involved by using either one of the Accounting Approach.

The above three Ledger Accounts mentioned in step-1 are related to type

Real Account(Cash A/c),Nominal Account(Purchase Return A/c) and Personal Account(GST A/c) in Traditional Approach.

Asset Account(Cash A/c),Asset Account(Purchase Return A/c) and Asset Account(GST A/c) in Modern Approach.

Step - 3In third step,we have to look at the nature or flow of the Ledger Accounts involved by using either one of the Accounting Approach.

Cash A/c - Comes In,Purchase Return A/c - Income and GST A/c - Giver for the business in Traditional Approach.

Cash A/c(Asset Account) increases,Purchase Return A/c(Asset Account) decreases and GST A/c(Asset Account) decreases in Modern Approach.

Step - 4In fourth and final step,now it is time to place the Ledger Accounts in their respective column, i.e Debit Column or Credit Column by applying the Debit and Credit Rule using either one of the Accounting Approach.

As a result,Cash A/c shows a Debit effect for ₹11,000.00Purchase Return A/c shows a Credit effect for ₹9,821.43 and

GST A/c shows a Credit effect for ₹1,178.57

Comments

Post a Comment